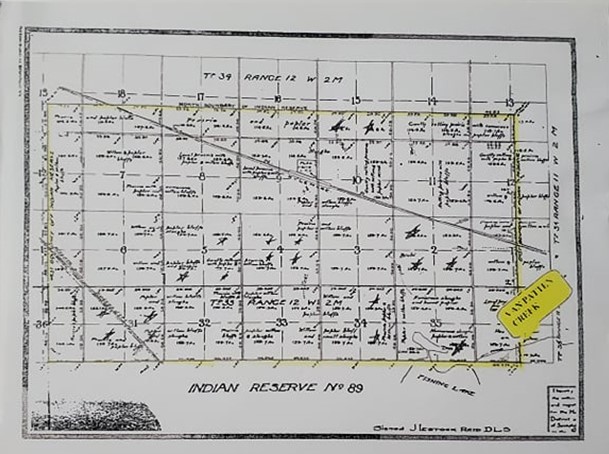

Original Fishing Lake Indian Reserve surveyed in 1881

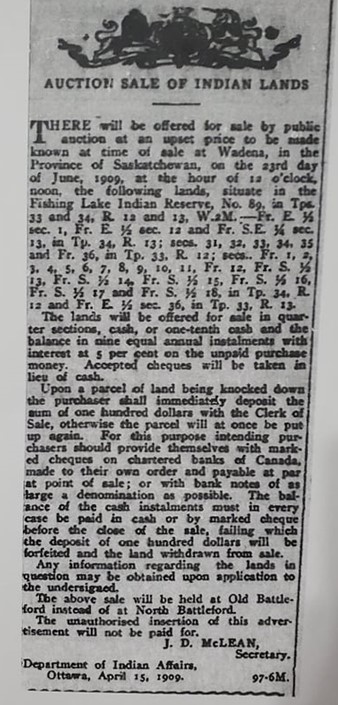

Canada could expropriate lands under the Indian Act and did so in this case. They expropriated 13190 acres of Fishing Lake Indian Reserve. The lands were intended to for newcomers or new settlers.

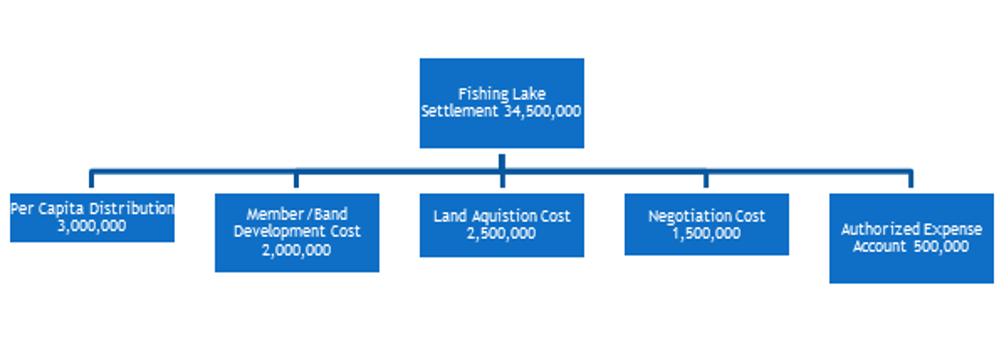

2001 Original Settlement Distribution

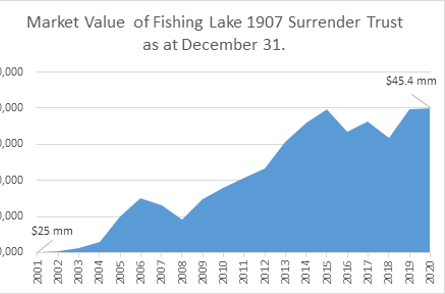

FL 1907 Surrender Trust & Jarislowsky Fraser

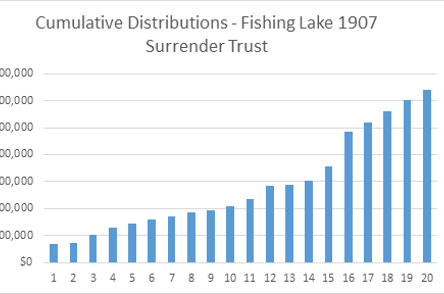

- Jarislowsky Fraser is proud to have been the Investment Manager on the Fishing Lake 1907 Surrender Trust since July 2002. Since December 31, 2002, the value of the Trust has grown from approximately $25 million to over $45.4 million with an annualized rate of return of 6.6%. In addition, this performance allowed the Trust to distribute over $28.5 million for Community Development, Land Purchases, Per Capita Distributions and Band & Member Development while growing the overall capital in the Trust.

The graphs show the growth of the Trust as well as the cumulative distributions from the Trust over the last 19 years.

Royal Trust Corporation of Canada 20-Year Anniversary Report

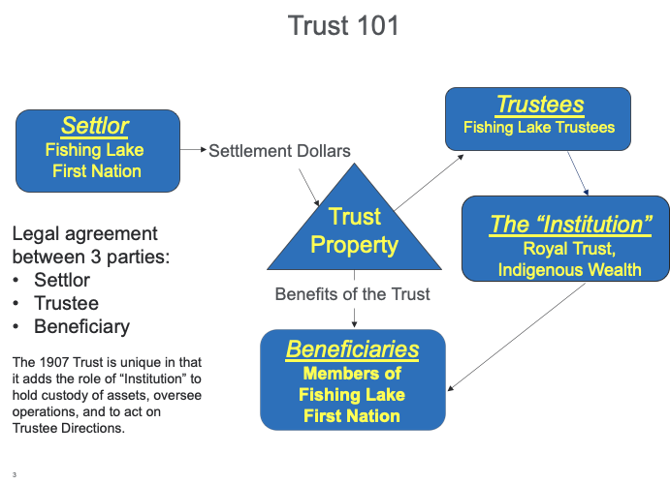

Royal Trust has had the pleasure of working with the Fishing Lake 1907 Surrender Trust since 2017, and fills the role of the “Institution.” The Trust Agreement, think of it as a rule book, outlines how Trust dollars are to be managed and invested, and requires that the Trustees hire an institution such as Royal Trust hold the Trust funds safely and securely. In the years of working with the Fishing Lake Trustees, it has been a pleasure to see their dedication to Fishing Lake First Nation, and the incredible amount of due diligence they put into making any decision.

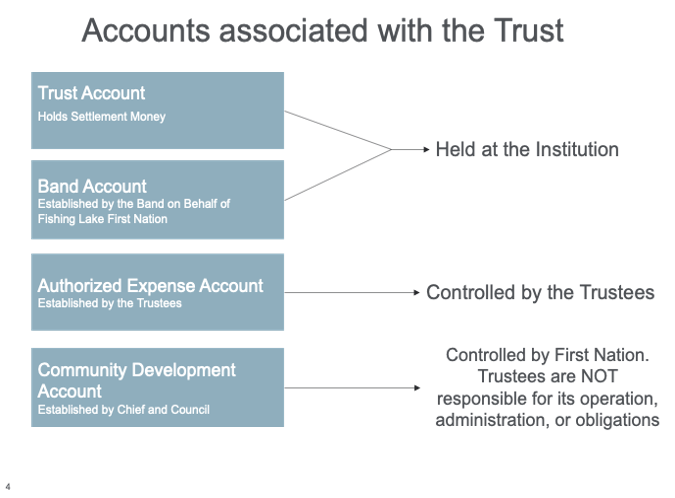

When the settlement dollars were placed in the Trust account 20 years ago, the intention was to keep them safe and secure. This is achieved by creating layers of oversight and ensuring that anytime a disbursement is made, it is done so in accordance with the rules of the Trust agreement. Because Royal Trust, rather than the Trustees, holds onto the funds for safe keeping, the Trustees cannot simply take money out of the account on a whim. In other words, whether funds are transferred for the purchase of land, or the Annual Distribution to the Community Development Account, Royal Trust can only make such transfers if the Trustees prove that all rules to do so have been followed. This process is outlined in the flow chart below.

The benefits of this Trust and these layers of oversight are found in the fact that over the past 20 years, the Trustees have, through sound investing, grown the Trust Fund to the highest value in its history, purchased many acres of land to be utilized by Fishing Lake First Nation, and made significant Annual Distributions to the Community Development Account.

To the Trustees of the Fishing Lake 1907 Surrender Trust, Chief and Council for the Fishing Lake First Nation and the Members of the Fishing Lake First Nation